“Why should we bother filling out the FAFSA? We make too much money and we’ll never qualify for anything anyway. It is a waste of time.”

Maybe you have said these words yourself or heard others say them. In some instances, it may be true. A family may be blessed with the financial resources that make filling out a FAFSA form irrelevant. But if you could fill out an online form in under 60 minutes that ends up giving your student the chance at being offered thousands of dollars in merit aid that has nothing to do with a family’s financial status, would that make you or someone you know reconsider whether it is a waste of time or not?

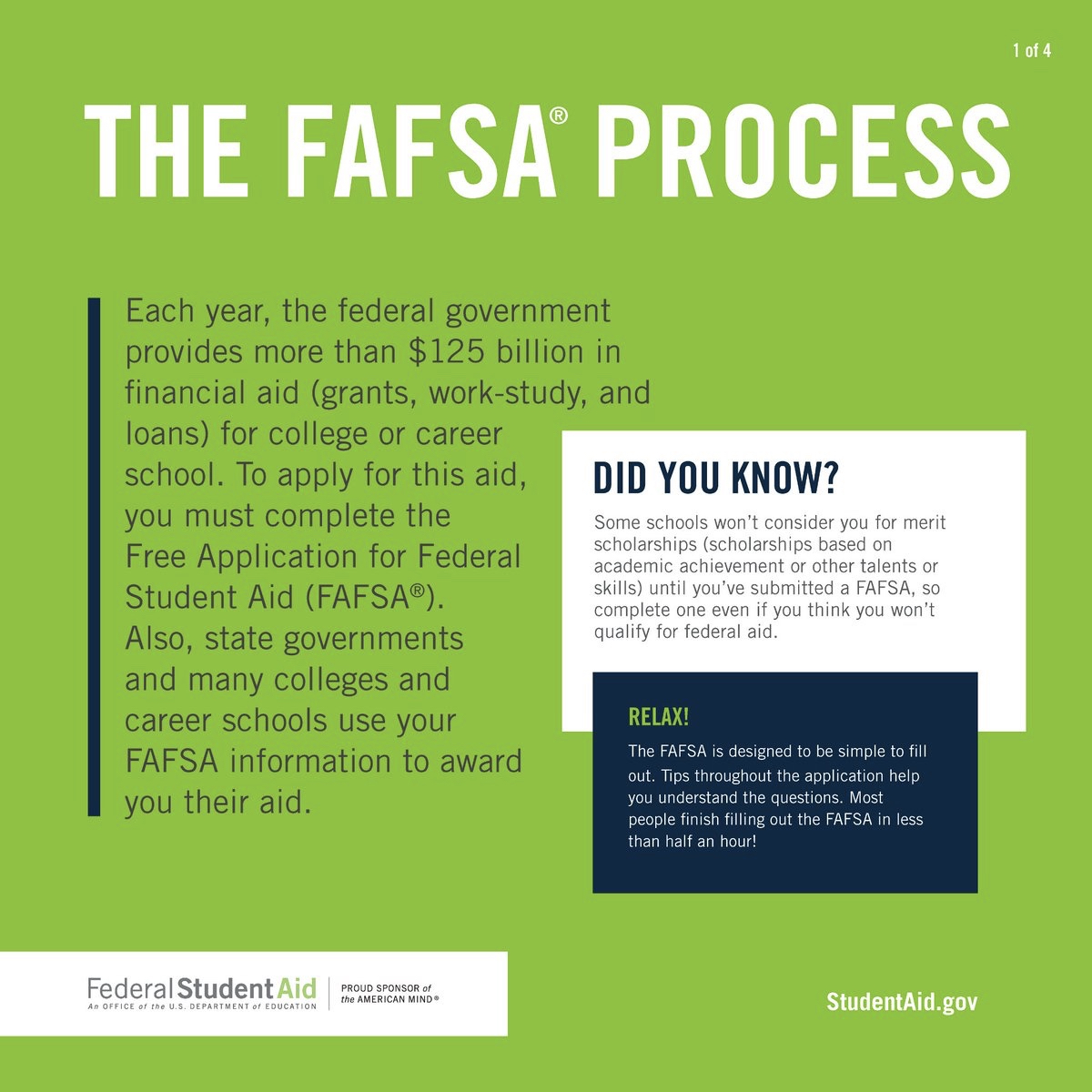

The FAFSA form, or the Free Application for Federal Student Aid, is the gateway to government aid for family’s who demonstrate the need for financial assistance in order to make college affordable for a student who is eligible to attend. In its original intent, the FAFSA gives the student a chance to attend a college that they work hard to be admitted to yet would otherwise be unable to afford without some financial assistance. This could be an offer of grants, loans, work-study, or a combination of these options.

But today a FAFSA is also used by colleges and universities as one of the ways to determine who to offer merit aid to and in what amount. Merit aid is just like it sounds – based on the student’s merit they have earned to gain admittance into a particular school. It could be based on grades, test scores, extracurricular activities, leadership positions, and other factors. These have nothing to do with a family’s financial circumstances or what a student’s family can or cannot afford to pay to attend a campus. Think of merit aid like a monetary award for a student’s hard work and achievement. Merit aid may be given as a scholarship or a grant to a student and it may be given in an amount that is good for one year or all four. Most often a student must meet certain requirements like full-time status as a college student or a GPA requirement to maintain their eligibility for the award and all of these details will be spelled out in any final offer that is given to a student.

These offers can also be a way to ‘get’ the top achievers of any application pool to choose a school. Kind of like a battle for the cream of the crop. The better the pool of students who accept your offer of admittance, the better your campus looks in the ratings. Often, a student who is at the top of their graduating class in high school, has several schools that would love to have them attend so admission’s officers know that there is some competition for that student. The reward for the hard work that a student puts in taking AP classes, taking leadership positions in clubs, volunteering in their community, exceling at placement exams, etc. can put the student in the running for a potential four year scholarship that pays for their full tuition or even their total expenses.

Some families may already have college savings that cover all of the expenses that will be incurred for their college-bound teen but, if a student does earn merit aid, those savings can now be put into use for a graduate program or professional school; an extended or additional study abroad program; a gap year between a bachelor’s degree and a professional job; or used for the next sibling who will be enrolling in college. Perhaps a parent never had a chance to earn a degree or has always wanted to return to school to earn a certification or study a particular subject. Those funds can also be used by the parents to pursue their own educational endeavors.

Note that some schools in the admission’s application paperwork will cite much earlier deadlines for filling out the FAFSA application than the actual FAFSA due date which is officially March 2nd, 2020 for California residents for the 2020-2021 school year. If a student is applying early action or early decision, many of those acceptance letters will include the merit aid package so schools need that financial information when they are making their early decisions.

One last consideration for filling out a FAFSA form each year, regardless of a family’s current financial status, is to have that form on file with the financial aid office just in case an unplanned family event happens that puts the ability to afford future college expenses in jeopardy. A family may file a ‘change in status’ form during a current scholastic year if a life event sheds new light on the student’s current ability to pay. Divorce, death, illness, or job loss are often unexpected and any of these kinds of events can drastically change the financial needs of a student. The first thing the financial aid office will ask is if the family filed a FAFSA application for the current school year. If the answer is no, the financial aid office will unlikely be able to help the family with the current year’s expenses until the new FAFSA period begins the following academic year. Most schools strive to maintain their current roster of students but the proper forms must be on file in order for them to offer assistance. This may mean that a student must leave school at the end of the current term and take an unexpected break. Having the FAFSA form on file is like having an insurance policy sitting at the ready with the financial aid officer in case it is ever needed.

Choosing whether to fill out the FAFSA form each year is an individual decision for every family but allowing a school to reward your teen for a job well done in high school or creating a security net for your student in case their parent’s financial status changes, seems like a pretty good trade-off for devoting an hour of time filling out an online form.

If you or someone you know could use some expert advice before tackling the FAFSA form for the 2020-2021 school year contact us. College4Careers can help filers avoid any pitfalls that may cost students a chance at thousands of dollars of aid.